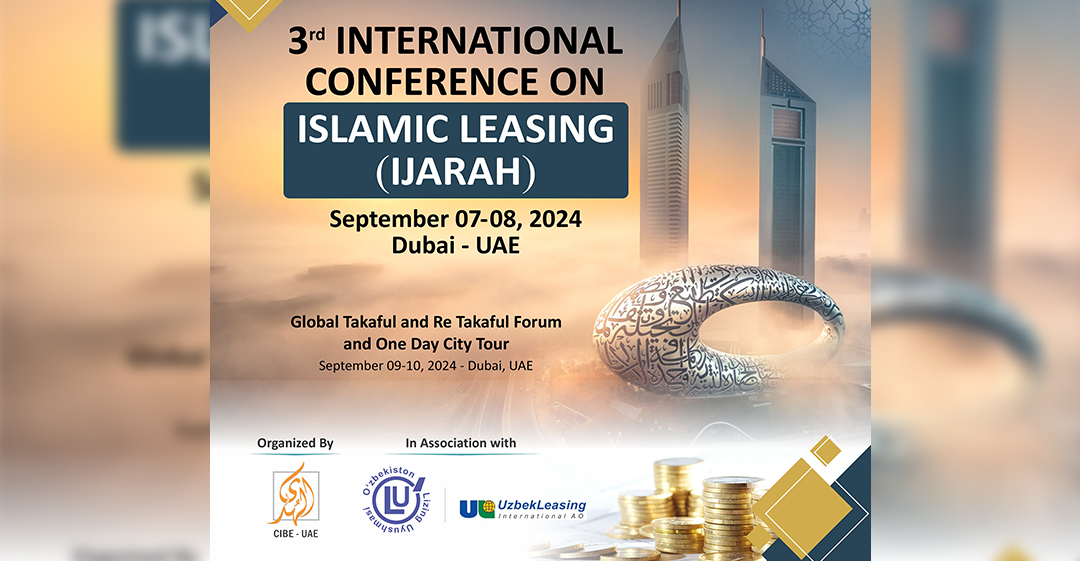

3rd International Conference on Islamic Leasing (Ijarah) Explores Innovation and Growth

Dubai to Host Event Focusing on Shariah-Compliant Solutions for Financial Inclusion

(Dubai, UAE June 06, 2024): The 3rd International Conference on Islamic Leasing (Ijarah) is set to convene in Dubai, United Arab Emirates, from September 7th to 10th, 2024. Organized by AlHuda CIBE in partnership with Uzbekistan Leasing Association and Uzbekleasing International AO, this prestigious event promises to be a pivotal gathering for industry leaders, experts, and stakeholders from across the globe. The conference will explore into the critical role of Ijarah, a cornerstone of Islamic finance, in driving growth, fostering economic sustainability, and expanding financial inclusion strategies.

The theme of innovation and growth will be central to the conference. Participants can expect in-depth discussions and presentations exploring the development of new Shariah-compliant leasing products. Experts will shed light on effective strategies based on Islamic principles that can unlock the full potential of Ijarah. A key focus will be on how Ijarah can contribute to the expansion of the Islamic finance industry worldwide, with the ambitious goal of reaching a $4 trillion market size by the end of 2025.

The conference transcends geographical boundaries, fostering a global exchange of knowledge and best practices. Delegates from over 15 countries are anticipated to participate, enriching the discussions with diverse perspectives and experiences. Prominent industry leaders will share their insights on Ijarah's role in promoting financial inclusion for both Muslim and non-Muslim populations. This commitment to financial inclusion underscores the conference's dedication to supporting the development of a more equitable and accessible financial landscape.

The conference program will be comprehensive and investigate into a wide range of topics relevant to the future of Islamic finance. Attendees can expect sessions focused on innovative product development in Islamic leasing, exploring new Shariah-compliant leasing structures that cater to evolving market needs. Investment opportunities within the Islamic leasing space will be analyzed, providing participants with insights into potential areas of growth and diversification. The conference will also explore the application of Shariah principles in fostering broader economic development, highlighting the contribution of Islamic finance to sustainable and responsible economic growth.

Mr. Mughal emphasizes the significant share of Ijarah holds within the Islamic finance landscape. He estimates it accounts for roughly 25% of the industry, followed by Murabahah (cost-plus profit) products at 46%. Diminishing Musharakah (home financing) sits at 12%, while Salam and Istisna (advance sale) products represent around 5%. Mudarabah and Musharakah (partnership-based products) hold a smaller share of approximately 2%, with the remaining portion encompassing other Islamic financing instruments.

Mr. Mughal highlights a key advantage of Ijarah: its ease of introduction in jurisdictions with limited legal frameworks for Islamic finance. He suggests that Ijarah products can be effectively offered in European and American markets without requiring significant regulatory changes. This accessibility presents a potentially lucrative opportunity for expanding the global reach of Islamic finance.

The conference aims to address this growth potential. By bringing together stakeholders, the event seeks to explore innovative product development in Islamic leasing. Discussions will focus on attracting investment opportunities within this sector. Additionally, the conference will examine the application of Shariah principles in fostering broader economic development. This holistic approach positions Ijarah as a key driver for not only financial inclusion but also sustainable economic progress.

Mr. Mughal emphasizes the critical role of the banking and finance sector in driving economic prosperity. He acknowledges the impressive double-digit growth of Islamic banking and finance globally in recent years. The conference seeks to build on this momentum by providing a platform for addressing potential challenges and strengthening support for the rapidly growing Islamic finance industry. The inclusion of topics like financial inclusion and Shariah principles underscores the conference's commitment to promoting a more inclusive and ethically sound financial system. By focusing on Ijarah's strengths and exploring its potential for further growth, the 3rd International Conference on Islamic Leasing promises to be a valuable platform for shaping the future of this dynamic sector.

The conference will be followed by One Day 6th Global Takaful and Re takaful Forum with one day city tour dated September 7th to 10th, 2024. To learn more about please visit: https://www.alhudacibe.com/icil2024/

About AlHuda CIBE: For over eighteen years, AlHuda Center of Islamic Banking and Economics (CIBE) has established itself as a cornerstone of the Islamic banking and finance industry. CIBE goes beyond mere research, offering a comprehensive suite of services designed to empower and cultivate excellence within the sector. Their distinguished expertise encompasses a variety of solutions, including advisory and consultancy services, Shariah advisory for ensuring adherence to Islamic principles, and training workshops equipping professionals with the necessary knowledge and skills. Furthermore, CIBE actively assists institutions in developing innovative Islamic financial products and provides specialized consultancy services for Islamic microfinance and takaful (Islamic insurance), fostering their growth and development.

CIBE's influence extends beyond its direct services. Their highly-respected publications on Islamic banking and finance contribute significantly to a continuously evolving and informed industry landscape. This unwavering commitment to knowledge sharing underscores their dedication to serving the global community as a unique institution, not just an advisor but also a capacity builder. Their dedication transcends geographical boundaries, with CIBE actively serving clients in over 35 countries worldwide. This global reach reflects their commitment to accelerating the development of a robust and accessible Islamic banking and finance industry.

For further details about AlHuda CIBE and its extensive repertoire of services, please visit: www.alhudacibe.com

For Media Contact:

Ms. Shaguftta Perveen

Manager Communications,

info@alhudacibe.com

Call: +971 52 865 5523