Islamic Leasing (Ijarah) innovative products can boost financial inclusion and out-reach: Zubair Mughal

(October 03 2019, Dubai): International Conference on Islamic Leasing (Ijarah) will convene in Dubai – U.A.E on 14th – 15th October, 2019 to explore and discuss innovative products of leasing under Shariah laws and financial inclusion strategies that can create clear pathways for growth and development of Islamic banking and finance industry. This Apex event is organized by AlHuda CIBE in Association with Uzbekistan Lessor Association and in partnership with multilateral organization for the Development of the Private Sector, ICD-IsDB. ICD-IsDB is one of the premier Islamic multilateral financial institution working for the development of the private sector including Ijarah industry.

Delegates from More than 25 countries will be participating in this prestigious event and eminent international speakers will be addressing in the event. Majority of the speaker are industry leaders and experts. AlHuda CIBE is striving for development of Islamic finance industry worldwide from last 14 years by providing advisory, consultancy, research and capacity building services and organized 7 annual events in different countries of the world. This event helps the industry practitioners to join the common platform and strengthen the networking for industry development in true and innovative ways.

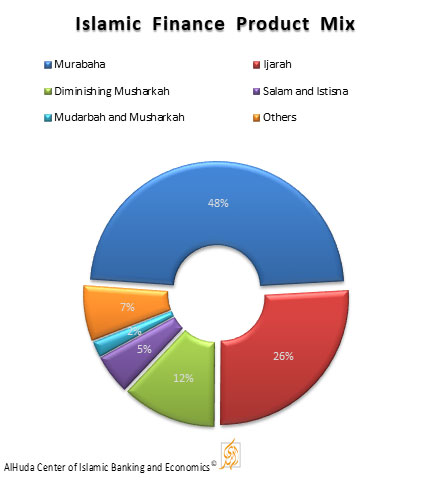

Mr. Muhammad Zubair Mughal, the Chief Executive Officer of AlHuda CIBE said that International Conference on Islamic Leasing (Ijarah) will explore how new and effective strategies (according to Shariah compliant procedures) be formulated for economic sustainability and growth. According to Mr. Mughal Ijarah (Islamic Leasing) have 24% substantial shares in Islamic finance industry followed by the dominant Murabaha (cost plus profit) product with the shares of 48% in global Islamic finance industry as mode of finance. While the Diminishing Musharkah (home financing) have its shares about 14%, Salam and Istisna (advance sale) have 5%, meanwhile Mudarbah and Musharkah (partnership based products) have about 2% and rest is belong to the other Islamic financing products.

Ijarah is very convenient product to launch in those jurisdictions where there is no proper legal and regulatory environment available to facilitate Islamic banking and financial products, he added. He argued that due to this feature Ijarah products can be introduced effectively and efficiently in European and American financial markets without introducing any additional legal and regulatory framework for enabling environment for Islamic finance products. By having Ijarah products in Weston conventional financial market, we can boost Islamic financial products a rapid pace and the overall share of Islamic finance can be reached at $3.0 trillion by the end of 2020. He also mentioned that Ijarah is a pure Islamic product and the leasing products were designed on the basis of Ijarah in 17th century to avoid the taxation and facilitate shipping industry. While narrating the theme and core purpose of the first conference of its kind in Islamic banking and finance market, Mr. Muhammad Zubair resonated his thoughts that economic prosperity and well-being massively depends upon banking and financing sector in any country around the world. It is also noteworthy that those sectors are trailing forward. In this connection the Islamic Banking and Islamic financing sectors have shown tremendous emergence globally by double digit growth from last several years. In order to include the people financially in Muslim and non-Muslim countries, a proper platform is needed to execute, valuing their cultural and social values, which is possible only through Islamic financing. Ijarah Sukuks are also one of its kind Islamic bonds with 157 issues are at the third position after Mudarbah and Murabaha Sukuk issues. The purpose of this conference is to gather the stakeholders under one platform, to find out the remedy to the financial potential problems to give a strong support to rapidly increasing Islamic finance industry. During the conference large variety of topics will be covered including; Islamic leasing (Ijarah), Financial Inclusion, Innovative product development, investment opportunities, Shariah Principles and General Economic Development.

The conference will be followed by One Day “Post Event Workshop on Islamic Leasing” dated October 15, 2019. This Workshop will cover a variety of allied topics. To learn more about please visit: http://alhudacibe.com/icil2019/

About AlHuda CIBE: AlHuda Center of Islamic Banking and Economics (CIBE) is a well-recognized name in Islamic banking and finance industry for research and provide state-of-the-art Advisory Consultancy and Education through various well-recognized modes viz. Islamic Financial Product Development, Shariah Advisory, Trainings Workshops, and Islamic Microfinance and Takaful Consultancies etc. side by side through our distinguished, generally acceptable and known Publications in Islamic Banking and Finance.

We are dedicated to serving the community as a unique institution, advisory and capacity building for the last twelve years. The prime goal has always been to remain stick to the commitments providing Services not only in UAE/Pakistan but all over the world. We have so far served in more than 35 Countries for the development of Islamic Banking and Finance industry. For further Details about AlHuda CIBE, please visit: www.alhudacibe.com

For Media Contact:

Ms. Shaguftta Perveen

Manager Communications,

info@alhudacibe.com

Call: +92 42 35913096 - 98