Zaib-un-Nisa

(Country Head, AlHuda CIBE - Uzbekistan)

The total volume of Islamic Banking and Finance assets grew to US$ 2.6 trillion globally. Iran, Saudi Arabia and Malaysia were the largest markets of the 61 countries that reported Islamic financial assets, with all three recording more than US$ 500 billion in assets.

The year 2020 appear to be relatively good for Islamic finance in terms of continuous growth and support for the real sector and infrastructure. Though, according to the recent S&P Global rating of the industry, the Islamic finance industry is set to grow at a rate of around 5% in 2020, due to weak economic conditions in the industry’s core markets and pandemic created by Covid-19. But the rise of three derivatives FinTech, ESG Sukuk, and standardization could fuel the industry in 2020.

The growth of Islamic finance industry in CIS countries is slower than other but it is attracting the attention of the global international banking industry due to the rising opportunities in this region. Islamic banking will grow substantially in CIS countries in the next five years from a low base, if their governments took initiatives to boost this sector. Kazakhstan, Kyrgyzstan, Tajikistan and Uzbekistan can be main players to lead this expansion of Islamic banking & finance in CIS.

The interest for Islamic finance is gradually growing in Uzbekistan. In 2003 and 2004, Uzbekistan has made significant steps towards recognition of Islamic finance via membership in the IDB and ICD. Stable relations between these institutions and the government have enabled Islamic finance to gain an entry point into this market.

93% of Uzbekistan’s population is Muslims but no local bank nor any foreign institutions offering Islamic banking and capital markets services other than the IDB and ICD. Although more than 9 banks get grant from ICD on Mudarabah base to start Islamic Banking but still waiting for legislation to be passed which allow them to work under Shariah. Foreign institutions are not prevented from engaging in the market without being registered in Uzbekistan provided they satisfy requirements contained in CBU Regulation. In May 2019 the Government of Uzbekistan issued a draft resolution to create infrastructure for Islamic banking and finance in order to foster alternative financing opportunities, expand the range of banking, financial services and to open the doors for Islamic investors from the Middle East. The Govt. of Uzbekistan is also planning to introduce the issuance of different tenure Sukuk (Islamic Bonds) to address the long-term and short-term liquidity and investment requirements of Islamic finance industry. Many educational institution start offering Islamic Finance education to its senior students. Many Insurance and leasing companies are also working to start Takaful and Ijarah operations to meet the need of the Islamic financial market in the country.

The promotion of Islamic finance industry in Uzbekistan will also attract the Foreign Direct Investment (FDI) in the country which will strengthen the economic growth of the country and will reduce the headcounts living under the poverty line.

For Islamic finance to gain an institutional position following actions need to be taken:

- It must be acknowledged at the legislative level

- An awareness campaign among people to promote the perception of Islamic finance and Islamic banking as interest-free alternatives to conventional banking and financial services must be started.

- Amendments would also be required to the Civil Code, the Tax Code and the major banking and investment laws to address this matter systemically.

- Commercial banks should be allowed to open Islamic windows or Islamic banking institutes should be allowed to set up independently from conventional banking

- To introduce Islamic banking and Islamic finance instruments, new rules must be formulated or amendments in existing ones should be done to accept the Islamic laws and procedures.

- Some Islamic Finance education and training courses at national level should be introduced to increase the basic and practical knowledge of people so that they can adopt this new change.

This forum appears as a milestone for AlHuda CIBE to promote Islamic Finance in Uzbekistan. Now AlHuda CIBE is providing services to many banks, financial institutions, leasing and takaful companies by organizing training and seminars to generate awareness among them, by offering online study courses to increase their knowledge about Islamic Finance, by providing certification and Advisory services to start Islamic Finance products in financial market of Uzbekistan.

In this Nobel effort, Leasing Association of Uzbekistan (ULA), Banking Association of Uzbekistan (UBA) and Association of Professional Participants of the Insurance Market of Uzbekistan are working with AlHuda CIBE and organized many seminar/training in Tashkent and Dubai to promote Islamic Finance among people.

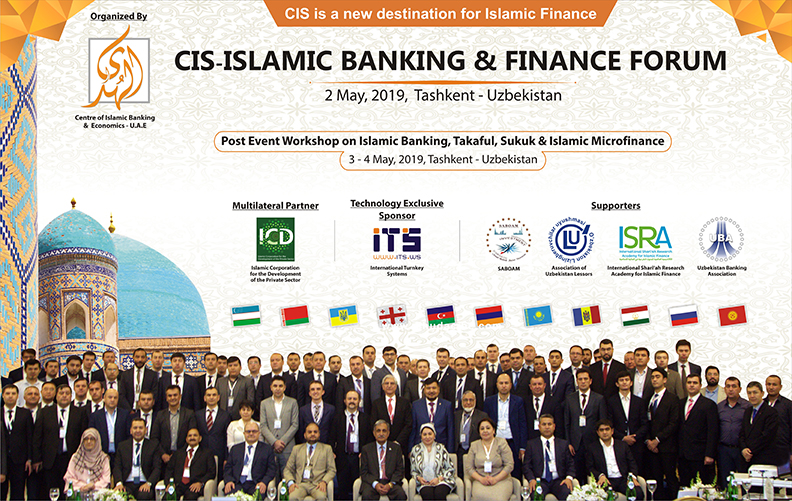

AlHuda CIBE has started research, advisory, consultancy and capacity building services in CIS countries for Islamic banking and finance industry from 2006. In this connection AlHuda CIBE has conducted various capacity building and training workshops and arranged conferences. It is expected that the volume of Islamic finance industry will increase by 100% in next five years which also will strengthen global Islamic finance industry, said the CEO of AlHuda CIBE. AlHuda CIBE is going to organize one more Islamic banking and finance conference of its kind in Tashkent, Uzbekistan on 13th-15th August, 2020. The CIS Islamic Banking and Finance Forum will gather the CIS Islamic finance industry specialists and stakeholders on a single platform to promote Islamic banking and finance phenomenon.

For Media Contact:

(Zaib-un-Nisa is the Country Head- Uzbekistan of AlHuda Center of Islamic Banking and Economics and she can be reached at zaib.nisa@alhudacibe.com )